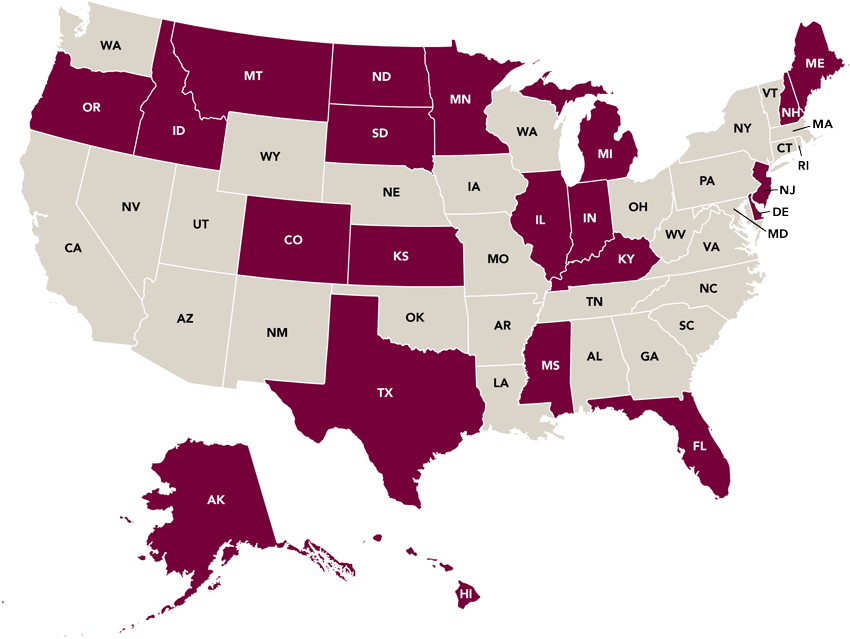

Several states and cities allow Colorado Mesa University an exemption on their sales and use tax. Please see below for a list of participating states and cities. Be sure to carefully read the instructions and notes provided for each state in order to determine what specific commodities are eligible for tax exemption in each location as well as how to comply with exemption requirements.

General Rules

- At no time may individuals use tax exemption for their personal use.

- Only direct purchases are exempt, unless otherwise stated. Example: an individual cannot pay for hotel accommodations and then be reimbursed; rather, the university must be billed directly, pay with university check or the individual must use their CMU OneCard for purchases.

Definitions

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Usually laws allow (or require) the seller to collect funds for the tax from the consumer at the point of purchase.

A use tax is a type of excise tax levied in the United States by numerous state governments. It is assessed upon tangible personal property purchased by a resident of the assessing state for use, storage or consumption in that state (not for resale), regardless of where the purchase took place.

List of States

List is in alphabetical order. Click on state name for relevant documents.

Alabama

- Not exempt

- Only allows exempt status for AL schools

Alaska

- Automatically no sales tax

- May have to pay local taxes

Arizona

- Not exempt

- Does not exempt universities

Arkansas

- Not exempt

- Only allows exempt status for AR organizations

California

- Not exempt

- Does not exempt universities

- Exempt

- Tax exemption also provides exemption from Colorado's retail delivery fee

- Provide CMU exemption certificate

- Exempt

- Provide CMU exemption certificate

- Exempt

- Provide CMU exemption letter

- Exempt

- Provide CMU exemption certificate

Connecticut

- Not exempt

- Must be 501(c)(3) to be exempt or be a CT government entity

- Automatically no state or local sales tax

- For DE gross receipts tax exemption, provide IRS determination letter

District of Columbia

- Not exempt

- Only allows exempt status for organizations with an office in D.C.

- Exempt - expires 12/31/2028

- Provide CMU exemption certificate

Georgia

- Not exempt

- Only allows exempt status for GA schools

Hawaii

- Automatically no sales tax

- May have to pay general excise tax

- Exempt

- Provide completed Form ST-101

- Exempt - expires 2/1/2029

- Provide CMU exemption number

- May have to pay taxes on lodging

- Exempt

- Provide CMU exemption certificate

- Have to pay taxes on lodging and meals

Iowa

- Not exempt

- Only allows exempt status for IA schools

- Exempt - expires 10/1/2028

- Provide completed CMU exemption certificate

- Exempt

- Provide completed Form 51A127

Louisiana

- Not exempt

- Only allows exempt status for LA schools

- Exempt

- Provide completed CMU exemption certificate

Maryland

- Not exempt

- Only allows exempt status for MD and neighboring states' schools

Massachusetts

- Not exempt

- Must be 501(c)(3) to be exempt

- Exempt

- Provide completed Form 3372

- Exempt

- Provide completed Form ST3

- May have to pay taxes on lodging, meals and rental cars

Mississippi

- Not currently exempt

- Contact [email protected] to apply for exemption

Missouri

- Not exempt

- Needed to provide officers' social security numbers for personal liability to receive exemption

Montana

- Automatically no sales tax

- May have to pay taxes on lodging and rental cars

Nebraska

- Not exempt

- Only allows exempt status for NE schools

Nevada

- Not exempt

- Only allows exempt status for NV schools

New Hampshire

- Automatically no sales tax

- May have to pay taxes on meals and rental cars

- Exempt

- Provide completed Form ST-5

New Mexico

- Not exempt

- Must be a 501(c)(3) to be exempt

New York

- Not exempt

- Does not exempt other states

North Carolina

- Not exempt

- Must be a 501(c)(3) to be exempt

- Exempt

- Provide CMU exemption certificate

Ohio

- Not exempt

- Does not exempt other states' governments who do not exempt Ohio's government

Oklahoma

- Not exempt

- Only allows exempt status for OK schools

Oregon

- Automatically no sales tax

- May have to pay taxes on lodging

Pennsylvania

- Not exempt

- Does not exempt other states

Rhode Island

- Not currently exempt

- Required $25 fee every four years to be exempt

- Contact [email protected] to apply for exemption

South Carolina

- Not exempt

- Does not exempt nonprofit organizations

- Exempt

- Provide completed CMU exemption certificate

- May have to pay tourism tax

Tennessee

- Not exempt

- Must be a 501(c)(3) to be exempt

- Exempt

- Provide CMU exemption letter

- May have to pay hotel occupancy tax

Utah

- Not exempt

- Only allows exempt status for UT schools or charitable/religious organizations

Vermont

- Not exempt

- Must be a 501(c)(3) to be exempt

Virginia

- Not exempt

- Must be a 501(c)(3) or 501(c)(4) to be exempt

Washington

- Not exempt

- Does not exempt universities

West Virginia

- Not exempt

- Only allows exempt status for WV schools

Wisconsin

- Not exempt

- Only allows exempt status for WI schools

Wyoming

- Not exempt

- Only allows exempt status for WY schools